Introduction

We all understand that the world changed drastically in 2020; lockdowns and travel restrictions forced consumers to behave differently. The way online shopping has grown and developed is perhaps the most remarkable example of this.

Consumers now have more power than ever. More and more retailers have transitioned at least a portion of their business into the online space, meaning consumers can choose the most convenient providers that best align with their values. With so many alternatives, it is incumbent upon retailers to satisfy those consumers or risk losing them forever.

What is clear is that consumers consider the delivery of their purchases to be a part of the overall online shopping process.

Ecommerce Consumer Report 2022

Ecommerce has been all about survival for retailers recently. Now, your point of difference is not if you offer ecommerce but how well you do it.

While many peripheral factors have changed, consumers value the same things they always have. Getting the basics right – delivering packages on time, for a reasonable price, in the condition that consumers expect – is more important than flash new delivery options.

Consumers want to be able to rely on a delivery arriving as and when they expect it to. In turn, retailers must be able to rely on their chosen delivery partners. It is especially pleasing to see how well New Zealand Couriers performs against consumer expectations. Consumers remember their deliveries from New Zealand Couriers, and they remember them as overwhelmingly positive. It is reassuring to have such precise data and commentary to share. It is also a pleasure to be sharing valuable market insights with the New Zealand eCommerce community.

Online Shopping Trends

Background information

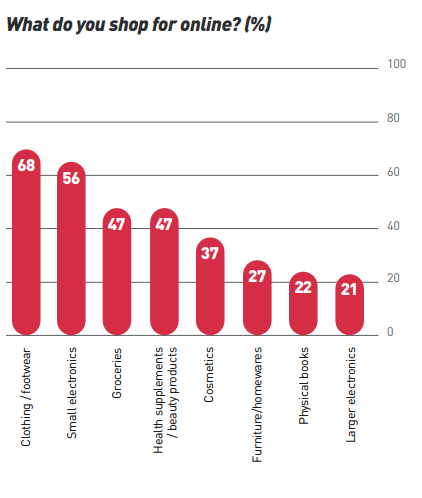

Kiwis have embraced online shopping, with 67% receiving more than 6 parcels per month. The top three categories for eCommerce in NZ are clothing and footwear, small electronics and groceries.

Perhaps unsurprisingly, younger people are more likely to shop online. However, older people are certainly not far behind – 54% of those aged 50 or older shop say they shop online at least once a fortnight.

Shoppers do their research

87% of online shoppers check delivery details such as cost, time frame and the ability to track their purchase before they commit to buying an item. Today’s consumers expect eCommerce merchants to combine easy to use, intuitive technology with informed customer service for an exceptional brand experience.

Online shoppers value having control over their delivery day and location. Consumers want flexibility to select delivery options that suit them.

APAC region

Online shopping in the APAC region is up 15.5% since COVID-19 started. Unsurprisingly, 66% of people receive more parcels than pre-COVID-19, with various alert levels directly impacting consumer behaviour.

Factors that influence shoppers to buy from a specific eCommerce brand or merchant:

41%

High quality

products

36%

Low delivery

costs

32%

Customer reviews

30%

Good product

information

33%

Promotions /

discounts

Since the onset of COVID-19, consumers are increasingly seeking convenience and immediacy. The permanency of these shifts will be determined by how satisfied consumers are with online experiences.

Delivery Trends

Consumers want more say in when and where they get their items.

When offered additional service options, shoppers are most willing to pay extra for a speedy delivery.

When asked to rate the importance of different delivery attributes or options, consumers considered extras such as drone delivery the least important. This speaks to the consumer’s desire for the basics to be done right over flashy ideas.

Top pre-purchase delivery considerations

Expected delivery

time

Ability to track

Returns policy

Cost of delivery

Ability to select

delivery time

Top delivery barriers

Slow delivery

Bad delivery

experience

No returns policy

Cost of delivery

Lack of delivery

information

Delivery Preferences

Premium items

Most consumers are willing to pay extra for careful delivery of packages that require extra attention. 68% say they would pay more for secure delivery of high-value items, while 64% say they would pay for the delivery of oversized or heavy packages.

Express delivery

Once again, consumers have reiterated the value they place on same-day delivery.

64% of shoppers would pay more to have their package delivered on the same day, while nearly half would pay more for weekend delivery or a range of express service options.

When delivery is the deal breaker

41% of consumers abandon their cart at the checkout if the delivery cost is too high, while 26% would abandon it if it would take too long for their item to be delivered. This shows that delivery details are more than just semantics and eCommerce merchants who provide the best delivery experience will win the sale.

Top delivery considerations when online shopping

76%

Free delivery

59%

Fast delivery

56%

Having tracking information

Setting a cart minimum for free delivery greatly increases Average Order Value (AOV).

26% of consumers would abandon the cart at checkout if it would take too long for their item to be delivered.

Ecommerce Consumer Report 2022

Ecommerce has been all about survival for retailers recently. Now, your point of difference is not if you offer ecommerce but how well you do it.

Transparency is key

Consumers have overwhelmingly stated their need to see cost breakdowns for their deliveries. 95% of shoppers say they must see the full shipping price, including prices for different delivery options.

Give the people what they want

Knowing when they’re going to receive their items is also hugely important. 94% of shoppers say they want a guaranteed delivery date. Some retailers offer express delivery options through local delivery from a customer’s nearest store. Local delivery can be faster than traditional shipping, provides more work for retail workers, and gives retailers more control over the customer experience.

95% of consumers expect to see all pricing before they check out

Successful merchants understand that covering the cost of an exceptional delivery experience materially impacts consumers’ decisions to buy their products and frequently leads to repeat sales.

Businesses should not underestimate receivers’ knowledge/preference of delivery companies. Delivery companies can expect to be remembered for their service, as two-thirds of receivers say they know which company delivered their last item. This rejects the common misconception that consumers believe all delivery companies are identical.

On top of that, data suggests that receivers have a favourite delivery company, with 35% of receivers saying that having the choice of delivery company is important to them.

Delivery issues

The most common delivery issue in NZ is longer than expected wait time. It accounts for 42% of all issues.

However, wait time is less of an issue for those aged over 50 compared to younger age groups.

Consumer not at home

88% of shoppers prefer to have items delivered to their homes, but nearly half don’t often have someone at home all the time to receive deliveries.

This makes easy redelivery or collection options crucial. When a signature is required, and no one is home, 44% of consumers prefer that parcels be left in a safe location.

- 80% Say their purchases were delivered on time, either always or most of the time

- 44% Prefer their parcel to be left in a safe place if they’re not at home

Sustainability

Sustainability is increasingly important for consumers purchasing online.

Packaging

72% of global consumers want brands to use sustainable packaging. However, only 18% of consumers are willing to pay extra. This suggests that while eco-friendly packaging wouldn’t be a popular add-on, consumers would prefer a sender they perceive as more sustainable overall without additional costs.

Carbon offsetting

18% of consumers say they are willing to pay to have their carbon emissions offset. However, 25% of rural consumers say they would pay extra.

Tracking

Consumers are paying attention. Globally, 86% of shoppers actively track either some or all of their deliveries.

How and when to update

Kiwis’ top three preferred modes of contact are SMS, email, or push notifications to their phones. Consumers want to know when their package arrives, but the update timing is important. 53% prefer an alert the day before delivery, and 26% want a notification on the day of delivery.

Tracking manages expectations

Because shoppers may need to arrange their schedules around receiving deliveries, tracking information must be as up-to-date and reliable as possible. Remember, delivery tracking is a key consideration when online shopping and delayed deliveries are the key reason for not meeting expectations. By reliably informing consumers about the progress of their delivery, merchants can manage expectations and avoid frustration.

Three main updates that Kiwis want

#1

Despatch date and

tracking number

#2

Information

about the progress

of their delivery

#3

Advance warning

if there’s a problem

or delay

Free returns?

What do consumers really want in a returns service?

When weighing up a free returns policy against other online shopping considerations, Kiwis much prefer free and fast deliveries with tracking information.

Just 30% of Kiwis say a free returns policy is one of their top considerations when shopping online.

However, 83% say having free returns is one of their top preferences when it comes to considering returns policies alone. This jumps to 93% for those aged over 50. 80% of consumers say they want their returns to be easy.

How long should it take?

Your customers do not want to wait, Kiwis expect returns to be processed within 4 days.

- 42% Say free returns is the most significant factor for a good experience

- 73% Say the returns experience affects their likelihood to buy from a retailer again

If you want repeat customers, it’s important to offer free returns.

The COVID-19 effect & looking forward

Online shopping is the new normal

There are now more online shopping deliveries than ever, with 70% of Kiwis saying they receive the same or more parcels than they did pre-COVID-19. It’s not going back either – 88% of those receiving more parcels expect to continue receiving more.

Globally, the proportion of eCommerce to retail sales is expected to continue to grow over the next five years. That means merchants of all shapes and sizes are more important than ever to offer a positive online shopping and delivery experience.

Ecommerce Consumer Report 2022

Ecommerce has been all about survival for retailers recently. Now, your point of difference is not if you offer ecommerce but how well you do it.

The COVID-19 effect

16.4%

Of global net sales were

in eCommerce at the peak of COVID-19 lockdowns

10 years

Worth of eCommerce growth happened in a three month period

84%

Of global consumers shopped online during

the pandemic

150 mil

People shopped online for the first time

40.8%

Average increase in

cost per click from January – July 2020

48.8%

Of shoppers say they’ll shop online more post COVID-19

How does New Zealand Couriers perform?

Network Testing suggests New Zealand Couriers is one of the best-performing delivery companies in the minds of consumers. New Zealand Couriers have more consumers that consider its delivery experience ‘Excellent’ than any other. 48% of consumers rate it at least 9/10, well above the industry average of 36%.

We delivered under pressure at the busiest times of the year

Consumers care about delivery

Merchants should not underestimate consumers’ knowledge of, and preference for, delivery companies:

66%

Of consumers say they know which company delivered their last item

44%

Of consumers believe parcel delivery companies in New Zealand are different

35%

Of consumers say that having the

choice of delivery company is important to them

Ecommerce Consumer Report 2022

Ecommerce has been all about survival for retailers recently. Now, your point of difference is not if you offer ecommerce but how well you do it.

11 min read

11 min read